Artificial intelligence is arguably the favorite investor story in traditional markets today, but the Web3 investor world has no intent to sit this one out despite not yet enjoying the fruits of the Bitcoin (CRYPTO: BTC) bull market.

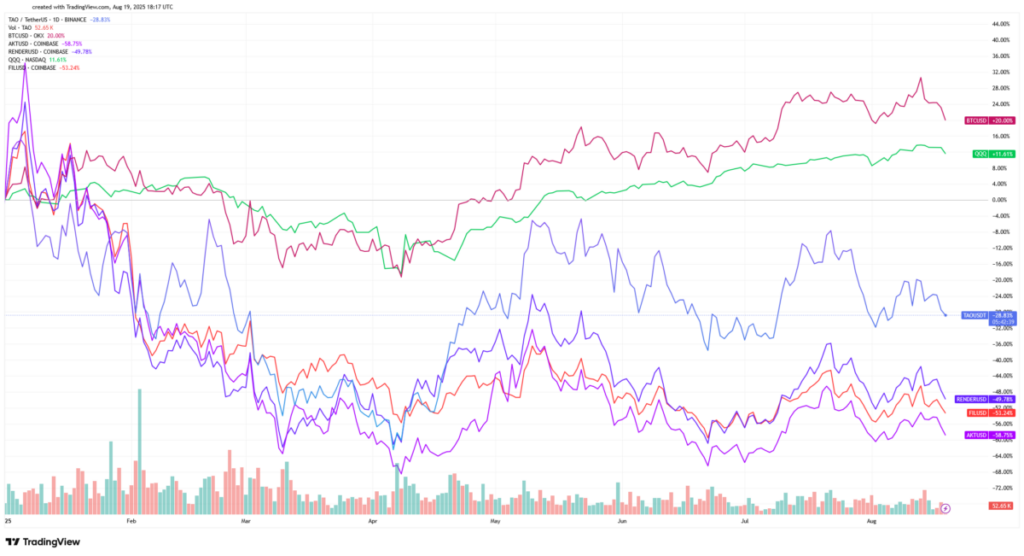

Decentralized Physical Infrastructure Networks, or DePIN, are underperforming Bitcoin generally speaking year-to-date. Crypto currency investors have been better off simply holding the godfather of all digital assets – BTC – and ignore everything else.

However, if long term trends hold on computing power requirements for AI, and if there is the expected demand increase for a decentralized backbone among the AI data centers in search of compute and storage space, then some blockchain tech companies will benefit.

One young company in this space, Bittensor (CRYPTO: TAO) went from around $93 when they first launched their token in 2023, to $348 during intra-day trading on Aug. 19.

"Investors flocked to these tokens because AI’s explosive growth demands unprecedented levels of data storage and computational power," said Michael Heinrich, CEO of 0G Labs in Singapore. 0G Labs says it is "building the world’s largest blockchain for AI." Their decentralized AI training framework called DiLoCoX trains large language models exceeding 100 billion parameters, the company said. Some investors have taken note. 0G Labs closed a $35 million pre-seed funding round in March 2024, which included investments from the Blockchain Builder Fund of Stanford University. Heinrich is a Stanford alumnus.

DePIN is a small market, building on the hope that a decentralized solution to computer storage and computer power is necessary for AI to expand. DePIN companies use incentives payable in their native tokens to coordinate the buildout and operation of network infrastructure on top of public blockchains, like Ethereum.

As of the second quarter of 2025, DePIN has a market cap of just $3.5 billion, though there are projections suggesting it could reach $12 billion next year – a quadrupling. (Note that everyone seems to have a different number. CoinGecko has the DePIN market cap at around $18 billion already.)

More than 13 million devices are already contributing to various DePIN projects every day, demonstrating how decentralized systems are gaining traction, according to Messari, a crypto analytics and research company.

AI models like ChatGPT need large amounts of high-speed computing power and data storage. Centralized providers like Amazon, Google, and Microsoft are straining to keep up with corporate demand, according to a January report by Recon Analytics.

GPU demand is rising along with prices for high end chips to build these networks. This has kept AI and chip makers largely in a bull market. The question is where can investors find similar action in the cryptocurrency markets?

"Centralized providers are struggling to supply affordably and making something you can scale," said Heinrich about having a computer system that allows users more space for storage when needed. "The decentralized alternatives have the ability to drive much greater efficiency, including reducing the cost of inference by up to 90%," Heinrich said.

For the layman, “cost of inference” refers to the computational resources – and expense for those resources – required to run a training model to make predictions or decisions on new, unseen data.

"If Web3 infrastructure supports a trillion-dollar AI market by 2030, the upside to getting in early is effectively uncapped," Heinrich said.

Largest Investable "DePin" Players

Each of these projects issues native tokens that fuel the marketplace and can be traded on major exchanges. Usage is tied to real workloads--not just speculation. These are the top five as ranked by market cap by CoinGecko.

- Bittensor (TAO): A decentralized machine learning network where contributors train models and earn tokens for making them available. It effectively builds an open marketplace for AI models, aligning incentives for both builders and users. (Market cap: $3.3 billion)

- Render Network (CRYPTO: RNDR): A decentralized GPU rendering and compute platform originally built for graphics, now positioning itself for AI inference. Artists and AI developers alike can tap underutilized GPU resources worldwide. (Market cap: $1.8 billion)

- Filecoin (CRYPTO: FIL): Filecoin operates a decentralized storage network where independent providers contribute physical storage capacity. The FIL token incentivizes these providers to securely store and retrieve data, creating a decentralized alternative to centralized cloud storage providers. (Market cap: $1.6 billion)

- The Graph (CRYPTO: GRT): Their protocol includes AI services being built by core developers like Semiotic Labs, including two new AI data services called Inference and Agent. These services enable decentralized hosting and deployment of AI models, facilitating AI integration into Web3 dApps. The Graph decentralizes the complex infrastructure needed for blockchain data search by incentivizing a distributed network of participants through token economics. (Market cap: $928 million)

- IOTA Network (CRYPTO: IOTA): Enables developers of physical infrastructure--such as internet-of-things devices and sensors--to participate in decentralized networks by contributing resources like data storage and computing power. Iota's tokenomics incentivizes participants to provide and maintain the physical infrastructure, rewarding them in its native cryptocurrency. (Market cap: $774 million)

Gregory Cowles, Chief Strategy Officer at Intellistake Technologies (OTCQB:ISTKF) said the surge into tokens like Render, Akash, and Bittensor were "a sign of a seismic shift in crypto investing."

Most of these have underperformed Bitcoin all year. Investors are trying to figure out which of these roughly 300 companies aren't just riding the AI-wave, but are bound to wipe out. There are very few trustworthy analysts out there with any measurable track record, especially given that many newer token issues are less than two years old. It is hard to know yet who is the real deal.

"The rush into data storage and computation tokens reflects a fundamental shift from speculative crypto plays to infrastructure with real utility," Cowles said. Intellistake is publicly traded in Canada. The fintech company is focused on decentralized artificial intelligence. They operate across the blockchain ecosystem, including proof-of-stake mining, running blockchain nodes, managing digital currencies, and validating transactions.

"What's truly revolutionary here is the tokenization of AI infrastructure itself--compute power, storage, and processing capacity becoming tradeable assets," Cowles said. "What's investable are the networks with proven demand and measurable usage. The hype? Any token slapping ';AI' in their name without demonstrable network activity."

Bigger Picture for Investors

For cryptocurrency investors, these infrastructure providers--whether centralized or decentralized--are where the picks-and-shovels investments lie. Most investors are going to look at the companies in this space that are on the Nasdaq, not something you buy on Coinbase.

Picking DePIN networks with staying power will not be easy. Investors have not been rewarded for long term holds on Filecoin for the last five years, having gone from a 2021 peak of $183.77 to around $2.38 currently.

Some companies will do well with their product offerings and even bring in traditional companies as clients, but will fail as an investment despite the overarching theme being in their favor.

The macro forces driving AI adoption and GPU scarcity are tailwinds for traditional tech, but cryptocurrency investors here have had mixed results. It's been a rough second quarter. Investors who are less risk averse, and like the DePIN theme, will find bargain basement pricing on some of these tokens.

The best DePIN investments will have tokens backed by measurable utility – namely computing speed, scalable storage, and AI workload capabilities.

"For long-term crypto valuations, this represents a seismic shift, I think," said Cowles. "We're moving from purely speculative assets to tokens backed by actual computing power."

Measuring that requires some serious analytics. Investors have to rely on the companies and the companies measure their computing power differently. For Filecoin, storage is important; and for Bittensor, it is AI computing power that matters most. Both companies are considered DePIN and both use fundamentally different metrics reflecting their distinct infrastructures and goals.

Overall, AI is straining the capacity of the traditional, centralized infrastructure needed for large data bases. Web3 has a shot at re-engineering the backbone of AI through its offering of computer speed and storage. They bring decentralization to that market.

Cowles explained in a blog post this month the modus operandi behind why many of the true-believer blockchain developers are getting involved: “When big centralized tech companies build AI, they’re not building it for humanity. They’re building it for shareholders. That’s not a moral judgment--it’s just basic economics. Every decision, every feature, every capability gets filtered through the lens of “How does this generate revenue?” or “How does this create competitive advantage?” With decentralized AI built on blockchain, we flip that equation entirely. Democratic ownership means democratic governance. Instead of a boardroom in Silicon Valley deciding how AI develops, we have actual users--all of us--having a say in the direction of the technology that’s reshaping our world. This isn’t just idealistic thinking. It’s practical risk management.”

If DePIN fulfills part of its promise, the tokens tied to these companies could see big gains at a fraction of the cost in the years ahead.

DePIN is in its earliest innings. It has an almost imperceptible market share of the $1 trillion market for overall computer infrastructure. Most companies are trading for a few dollars per token. Ocean Protocol (CRYPTO: OCEAN), which runs the Ocean Marketplace, decentralized data sharing to fuel AI training datasets, trades at $0.28.

Last year, Messari analysts forecast DePIN to grow 100-fold over the next decade as the newer Web3 networks win market share from the big centralized companies like Microsoft. Investors will have to wait and see if that call is correct.

Disclosure: The writer is an investor in Bitcoin and a former investor in The Graph.

Benzinga Disclaimer: This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy