Eric Trump, the executive vice president of The Trump Organization, expressed his optimism about the future of cryptocurrencies in an interview aired Friday, predicting a surge in the fourth quarter.

Why Trump Finds Crypto Incredible

During an interview with the New York Post, Trump said that the industry is going faster than the internet and the future looks “incredible.”

“I think fourth quarter this year is going to be unbelievable for a host of reasons,” Trump predicted. He reiterated that Bitcoin will eventually reach $1 million.

He predicted that the Federal Reserve would soon return to quantitative easing, a policy in which the central bank purchases bonds to pump cash into the economy. Trump argued that the increase in M2, or money supply, would be win-win for cryptocurrencies.

See Also: Cathie Wood Says Bitcoin ‘Owns The Cryptocurrency Space’ -- Here Is Why The Ark CEO Differs With Tom Lee On Ethereum

The Q4 Advantage?

Trump also highlighted that historically, the fourth quarter has been best for cryptocurrencies. On average, Bitcoin has returned 85% during the fourth quarter.

He also highlighted the role of companies in making cryptocurrencies more accessible to the general public, specifically mentioning American Bitcoin Corp. (NASDAQ: ABTC), which he co-owns.

“Anybody who can buy an equity, anybody who can buy stock, anybody who has a 401k, can invest a small amount in an asset that has had absolutely parabolic growth,” he stated. “It’s easier to access cryptocurrencies for the first time now than ever before.”

Trump Family’s Bold Bet On Crypto

Trump said last month that his businesses were abruptly excluded from the financial system as part of what he believed was a broader campaign against his family and conservatives. This experience led him to embrace cryptocurrencies, which he sees as a way to bypass traditional banking systems.

The Trump family has expanded its involvement in the cryptocurrency sector. In addition to taking American Bitcoin, a mining company, public, they also oversee World Liberty Financial (WLFI), a decentralized finance platform.

Price Action: At the time of writing, BTC was exchanging hands at $111,704.11 up 2.16% in the last 24 hours, according to data from Benzinga Pro.

American Bitcoin shares closed 0.09% lower at $6.600 during Friday’s regular trading session. The stock is down 4.6% since its debut last week.

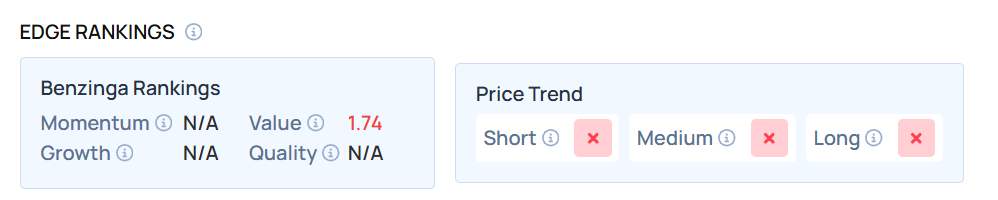

According to Benzinga’s Edge Stock Rankings, the stock lagged on the Momentum metric, and was in a downward trend in the short, medium and long term. Find out more here.

Read Next:

- The Big Mac That Cost $380,000: Why The Early Bitcoin Believer Who Paid 3.5 BTC For The Burger Has Zero Regrets

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Photo Courtesy: Joseph Sohm on Shutterstock.com